November 22, 2024 / Industry, Marine News

“Twice Hornblower made the whole journey, battling with the disquiet of his stomach at the thought of the one-hundred-foot drop below him… Hornblower told himself—as indeed as he had said to himself when he had first seen men go aloft—that similar feats in a circus at home would be received with ‘ohs’ and ‘ahs’ of appreciation.”

-Mr. Midshipman Hornblower by C.S. Forester

Drones

The technical areas of maritime shipping increase rapidly with multiple ways of reducing emissions from dual-fuel engines and wind assistance and to computerized control of engines, wind assistance, and route planning. With these increasing technical advances, the certification and ongoing inspections of the systems grow more difficult. Technical advancements are also being made for vessel inspections. One of the fastest growing in all forms of vessel inspections is the use of drones.

In its early years, drones were used for basic external inspections. At the time, DLS Marine was using a drone with a high-resolution camera to take external videos of vessels that could be used for reference. These videos could be used by the vessel builders for marketing purposes. In addition, vessel lessors or owners use these external videos at the time of on-charter, and some have used annual videos to track the physical condition over the charter period. When COVID arrived and prevented some travel (particularly international travel), DLS collaborated with a licensed drone operator in Scotland to create videos of two Offshore Supply Vessels in Aberdeen, Scotland.

Some may wonder about the usefulness of a video made 100-ft away from an object. One amazing aspect of drone video is that an owner, charterer, underwriter, or class surveyor sitting in front of a computer screen can stop the video and, with the use of current high-definition cameras, zoom in on a desired section and get a clear view as if their eyes were inches away. Their view can be like that of an onsite inspector. As the technical advancements of drones, cameras, and software grow, so does the use of drone.

Cargo hold inspections are another area where drones can be of great benefit. Peeling paint, rust, dirt, sand, and past grains residues can void the acceptability of the hold for the next cargo. The drone can provide a clear view of the hold’s physical condition and its suitability for prospective cargoes without the need for a physical inspection. Having spent several years dealing with bulk carriers, I am aware of difficulties in inspecting these holds. Not only is it physically demanding to climb 40’ vertical ladders in and out of four or five cargo holds, but when it is a special survey inspection for Class or Port State Authority, the condition of framing – particularly in the upper areas of the hold where bucket damage can occur during bulk cargo discharge – is of particular interest. In the past, we have done such inspections riding in a man-lift that has been lowered into the cargo hold to get close enough for inspection; however, this method requires moving the man-lift in steps around the periphery of the upper hold, taking notes and photos as you go, and this can take several hours. Now that we perform these types of inspections with drones, it can be done in about an hour without any outside shipyard help. Such an inspection can be viewed in process or for future reference.

Inspecting internal areas like the cargo spaces of tankers – or any vessel’s fuel, ballast tanks, or void tanks – is time consuming, expensive, and dangerous to crew members and inspectors. These physical inspections might often require erecting scaffolding to look for things such as deterioration, special coatings, metal thickness, and overall cleanliness. It is also a process for the safety of the personnel working inside the tanks, and it creates additional costs in preparations and in extended downtime of the vessel; therefore, it can result in lost income.

One international drone inspection company stated that the use of drones can reduce the overall time of tank and void inspections by 90%. They also spoke of how a Floating Production Storage and Offloading vessel (FPSO) can reduce the time of a tank inspection from the usual two weeks to four days. On an offshore drill rig with sixty-three tanks, what would usually take 3-person teams several months- could be done by a drone team in only fourteen days. DLS uses a drone with similar capabilities and has made it a priority to keep up with this technology. DLS is certified by American Bureau of Shipping Class as a Recognized Service Supplier for Remote Inspection Techniques as an alternative means for close-up survey of ships and mobile offshore units.

The hi-res videos are available to involved parties at any desired time. While a viewer can watch as it happens in the future, one can look back at these inspections via a Digital-Twin. Areas of a present inspection of interest or concern can be marked up and compared with the newer ones allowing historical comparisons.

What is Drone Technology?

Over the years, I have gone into the new terminology in the marine industry, wind farms, and batteries, and now I am fascinated to learn about drones. Drones can be for confined space tether operation, traditional external GPS guidance, or 360° walk‑throughs. Artificial Intelligence (AI) and Machine Learning (ML) have also become a part of this science. The confined space drone that DLS operates has a Det Norske Veritas (DNV) algorithm that detects cracks. The drone also has a gas sensor onboard that relays current levels of gases back to the pilot in a telemetry section of the flight application. These are impressive feats, and it is certain that drone capabilities will grow along with AI and ML.

Most drones have batteries on board. Now that drones are being used for lengthy inspections in confined spaces, they are usually tethered. One tethered type we currently have in use has 3-D Laser Imaging Detection and Ranging (LIDAR), Beyond Visual Line of Sight (BVLOS) operation, and a 4K high-resolution camera. It is tethered to a ground station at the operator. Because it is tethered to a ground station, it gets power from a local power source such as a wall outlet or portable AC generator. The absence of it having on board batteries allow it to have an unlimited flight time. The tether is important not only to the flight, but because it also powers a lamp that has over 10,000 lumens (li).

While the knowledgeable marine drone operator has control via a tablet/controller, offsite observers can view live streaming of the inspection footage via a web-based portal. This footage can be shared with clients and stakeholders. This is done via Simultaneous Localization and Mapping (SLAM). The web portal is the central repository where a digital twin can be reviewed, surveyed, inspected, and compared to previous inspection missions.

The Aging World’s Fleet

These aren’t the roaring twenties – more like the terrifying twenties. The days of simple supply and demand have been shaken up by situations such as COVID, canal and lock surprises, flooding, droughts, Ukraine, Eastern Mediterranean and the Red Sea shipping crisis. File them under geopolitics and climate, both unpredictable. Internationally, all of the five major shipping segments have volatility. Over the past several years, the ranges of rate peak-to-trough look more like EKG rhythms. When maritime leaders were asked their opinion of 11 risk factors in 2023-2024, the top concern was political instability followed by malicious physical attacks and cyber‑attacks.

New vessels have become expensive due to material costs, shortages of suitable shipyards, and high interest rates. The banks that have historically financed the industry with asset-based lending have been generally replaced by leasing companies and alternate financiers. The latter two have more liquidity than banks with their debt limit regulations. Decisions are now clouded on where things may be going.

There are a lot of LNG ships being built to fill the demand for the transportation of LNG and green LNG from the growing areas of production to the growing areas that need LNG for ship fueling. The problem in this sector is that these new ships will be arriving before the complicated and expensive production sites and storage/bunkering sites can be built. The current rates for LNG tankers are dropping below their operational costs.

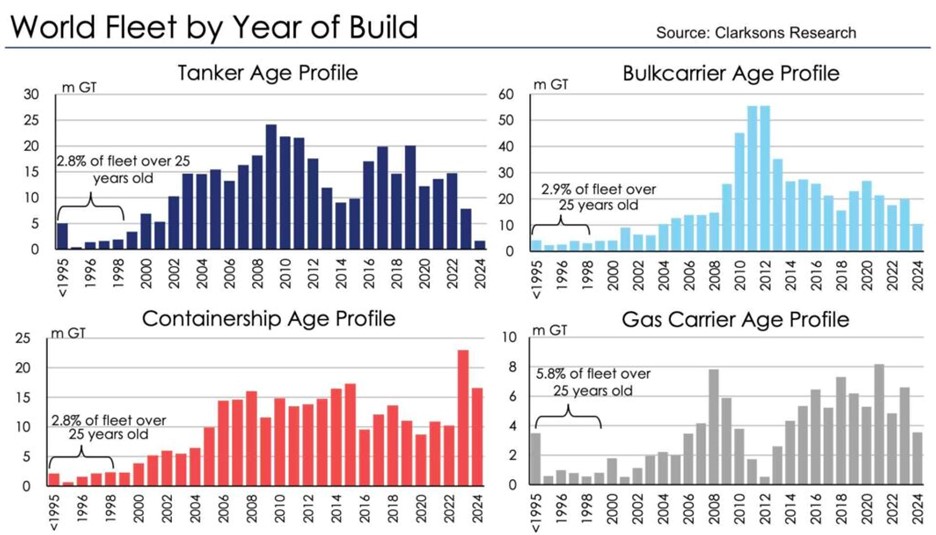

The international fleet aging will put pressure on those interested in vessel condition such as class societies, Port State Authorities (PSA), and charterers.

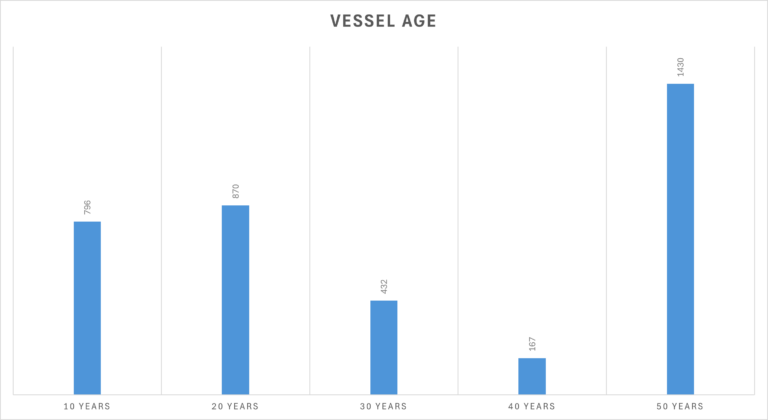

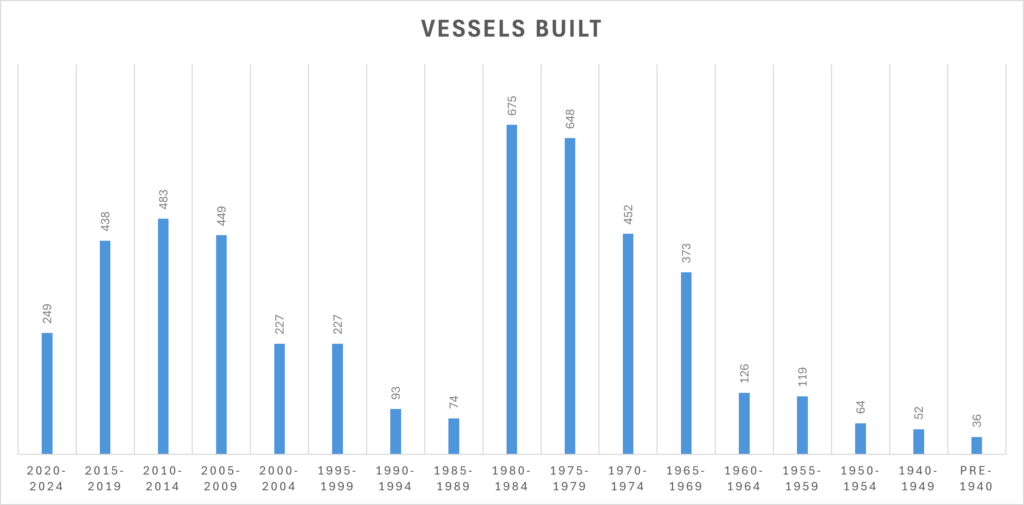

The United States fleet figures are also of interest. The United States Coast Guard provided us a list dated May 1, 2024, of all the U.S. vessels that have USCG Certificates of Inspection. This is not of all U.S. vessels but those that are inspected by the USCG. The list does not give a clear breakdown of the included types as all are listed as Towing Vessels. They appear to be mostly coastwise, harbor, and inland river tugs, some with Great Lakes listed and some as ATBs. Many vessels listed as General can be anything including ocean service tugs and ATBs.

The total list contains just under 5000 vessels. I calculated numbers in 5-year increments with these vessels ranging from the oldest one built in 1897 through 2024. These ages are all of their date of construction and do not factor in updating and rebuilding. Remember that the older pushboats listed have had upgrading of various levels to comply with the 2016 Subchapter M safety regulations.

The following is a table DLS created to represent the data of USCG Inspected Vessels built:

There are 1,251 vessels aged 49 and older. Of those, there are 52 vessels from the WWII era between 1940-1950, an early era of mass construction. Following decades show the past growths and slumps powered by domestic economics.

Comments on the future

In a recent virtual conference interview, Dr. Martin Stopford, the head of Clarksons (and considered the Warren Buffet of the marine industry), had some views on future needs. Stopford believes globalization may be refocusing on the integration of maritime regions and short sea shipping, and that even small ship owners can succeed by harnessing technology as simple as modern cell phones.

Companies not only have to refit their vessels to meet regulations and the desires of users but also need to refit their organization. Yes, companies have operated on cost minimization mostly of office overhead, but this has not always built a good staff. Such staff building can take 10 years. Dr. Stopford also looked at the technical skills that will be necessary to develop new ship designs and retrofitting. The future is speculative. It will not just be about the changes in ships and business but also the changes in digital information systems that are already used in the operation of ships and the operation of cargo movements. In another conference, a ship owner commented that the internal building of a successful business will take time as AI doesn’t do this type of building.

These comments by Dr. Stopford reminded me of the phrase, “you know tech but you don’t know the business.” Truth is, you need expertise in both.

Dr. Stopford, talking about the next 10-20 years, a small molten-salt nuclear reactor could cost $150MM and its fuel around $250MM. While those are very high construction numbers, a 100,000 MT tanker could save $120-150MM in fuel over the course of its life.

Inland

The volume and cost of river barge movements continues to Yo-Yo in correlation to the water depths.

The coal market on the river continues to fluctuate in relation to the price of natural gas. After purchasing too much coal in anticipation of conflict with Russia and Ukraine, plants were left with excess stock to burn. As a result, coal movement on the river has slowed. The demand for electrical power has grown due to weather conditions as well as large consumers like Amazon and Microsoft. Such groups buy large areas of land to construct energy gobbling data centers. (Their moves to solar, wind, and nuclear energy are of side interest). Delivery of coal is strongest in the Ohio River valley area.

Overall, the need for coal domestically has fallen to multi-decade lows, helped by the drop in the cost of natural gas. Renewable energy sources continue to grow. Utility‑scale solar energy has a year-over-year surge of 31.6%. Wind powered electricity in the second quarter of 2024 rose to 125.0MM MW hours over the previous year period of 102.7MM MW hours.

Over the last six months, the export of corn, soybeans, and wheat have been higher for the most part over this period in 2023. The unshipped (a term differentiating purchases and the cargo leaving the country) corn export market currently is at 12.51MM metric tonnes compared to the previous year at 10.51MM metric tonnes. The soybean market during the same period is nearly unchanged from 16.29MM metric tonnes.

China has been a strong customer for U.S soyabean exports. Their imports of beef and chicken are up while pork has decreased as a large portion of the 1.4bn is a centi‑millionaire population expanded by 108% in the past 10 years. This affects the U.S. because China purchases genetically modified soybeans for pig feed. U.S exports to China are also expected to drop. Brazil, among other countries, is a favored exporter of soyabeans to China. As always, commodities, volume, and price will chase markets all over the world. China in 2023-24 has imported above standard amounts of soyabeans from the U.S., but this is believed to have been stockpiling in anticipation of tariff wars.

This is a factor of interest to owners of bulk carriers and reefer ships.

Imports through New Orleans are down 12.5% from this time last year and 8.5% from the prior quarter. This is in the usual raw materials, iron ore, bauxite, and steel. Some of that is due to a drop in U.S. steel production. Fertilizer imports are seasonally down and cement up a small amount after a 2023 early 2024 slump. Salt is weak due to warmer periods in the north.

Kirby reports continued higher income from its inland fleet due to much higher margins.

-Norman Laskay

If you’d like to keep this conversation going, please email me at nlaskay@DLSmarine.com