“The left side of the balance sheet has nothing right, and the right side of the balance sheet has nothing left. But they are equal to each other. So, accounting-wise, we are fine.”

-AIG Vice Chairman Jacob Frenkel’s description of AIG’s balance sheet, given to a group of top global bankers at a lunch in the aftermath of the 2008 crisis.

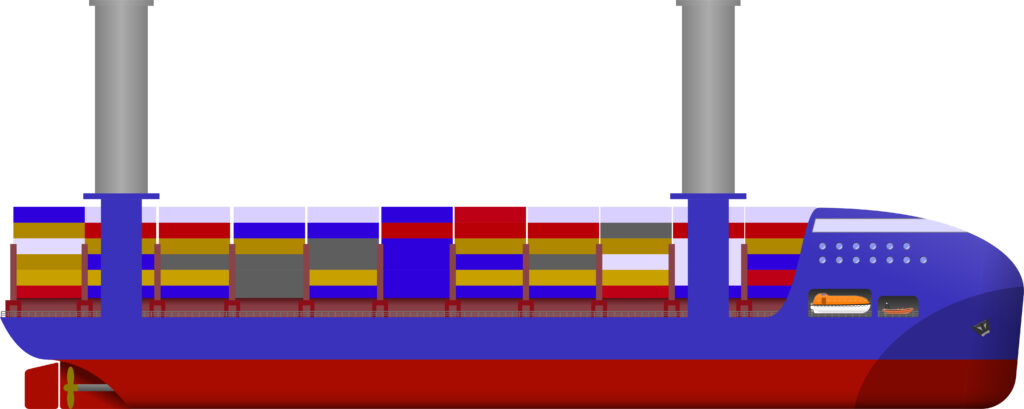

Changes in the maritime industry are expected to occur due to geopolitical shifts during the year. These changes will influence economic reasoning and patterns. With 80% of the world’s raw and completed products moving via merchant vessels, changes affecting the maritime sector will impact product costs for consumers. Most of these changes are expected to result in cost increases, either briefly as supply lines adapt or over longer periods as supply chains evolve.

Containers

With the large volume of imports from China, the anticipated increase in tariffs on goods between the U.S. and China will lead to straightforward cost increases for Chinese products or adjustments by shippers in their supply routes.

Adobe Stock Image

One international change already in effect since COVID-19, and now accelerating, is the relocation of manufacturing from China to other countries or into their own country. Some countries are also having to decide on placing tariffs on Chinese imports to protect their own industries. There is the growing strategy of shipping Chinese-produced goods intended for high-tariff countries through intermediary nations. China has already invested in Pacific Ocean ports in Mexico and South America, though potential disputes between the U.S. and Mexico may complicate this strategy.

Gas

China is a major importer of U.S. LNG and LPG. While international demand for these products is expected to continue, shifts in consumer markets and increased U.S. production and export capacity could affect prices. The cancellation of the agreement between Russia and Ukraine, which allowed the movement of Russian-produced gas to the EU via a trans-Ukraine pipeline, will also influence EU demand.

Tankers

Tighter restrictions on the shipment of Russian and Iranian oil, influenced by U.S. government actions, may lead to price adjustments and increased U.S. exports. This would be beneficial for tanker operators. Additionally, efforts by certain countries to combat the “shadow fleet” that transports Russian and Iranian oil could benefit legitimate tanker operators. By removing the older, less reliable, and often uninsured tankers from service, the demand for compliant tankers would rise.

Dry Bulk

The first tariff war under President Trump negatively impacted U.S. farmers, with Chinese imports shifting to other agricultural producers. Beyond grain, this also affected steel, LNG, and LPG. Since 2017, Chinese imports from the U.S. have fallen by 8%.

Car Carriers

China is a major exporter of electric vehicles (EVs), closely tied to its dominance in producing electrical batteries. Tariff policies, such as those under the Trump administration, could significantly impact consumer costs for EVs. The EU is also taking similar actions against China imports.

The conclusion is that international maritime companies anticipate a year marked by uncertainty and volatility. The interconnectedness of global manufacturing and trade networks underpins the modern economy.

To adapt, technological advancements in data analytics and AI will play a crucial role in maintaining supply chain visibility. The supply chain involves not just producers and buyers but also the maritime industry, whose routing decisions are increasingly influenced by environmental regulations, modern bunker site locations, and political conflicts that can affect vessel routing.

FuelEU Maritime Era

While geopolitical challenges will place pressure on the maritime industry, the FuelEU Maritime regional regulations, which came into effect on January 1, 2025, will also have significant economic impacts. These regulations, although complex, are not expected to heavily affect U.S. vessels but will economically impact much of the international fleet, indirectly influencing global product costs.

The actual calculation on how this new legislation will raise the cost of vessel operation will be complicated. But it will be done using these basics.

The regulations target stricter GHG emissions reductions for vessels over 5,000 GT operating in EU ports. It will not just be on voyage exhaust but also the exhaust of a vessel while in port. Targets include a 2% reduction in carbon intensity by 2025, increasing progressively to 80% by 2050, starting with the basic intents set by the 2000 IMO plan. Compliance will be measured using the well-to-wake method for fuels. Wind-assisted propulsion credits and pooling of compliant and non-compliant ships in EU service are available to operators. One sample was a ship using the biofuel blend B30 in a pool that could offset eight other ships using normal fuel oil.

Non-compliance will result in penalties based on fuel consumption. For example, a bulk carrier operating between South America and the EU could face a 5.1% increase in fuel costs. With fuel representing at least 60% of annual costs for ocean service vessels, these regulations will significantly impact profit margins.

Clarksons Research has stated that 38% of ships over 5000 GT have made EU port calls.

Adobe Stock Image

While fuel choice is and has been important, under the new legislation for EU service, the fuel choice gets more complicated.

Presently, compliance will be met by using dual fuel engines with LPG or LNG. Their compliance edge will decrease as the legislation limits rise and will be open to penalties in 2040. However, the measurement of biofuels will be different under this new law.

Biofuels made from feed crops or even food will have their emissions treated as if they are conventional fuel. Now it will be biofuel made from animal fat, waste, or used cooking oil that will be considered as a bio product. It has been said that trailing behind a vehicle burning used cooking oil from a fast-food restaurant in its diesel was pleasant. How this might be on a ship might be interesting.

As part of the 2025 Phase 3 of the IMO Energy Efficiency Design Index (EEDI), it requires a 30% reduction compared to the original baseline set for different vessel designs.

In addition, in 2009 IMO adopted The Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships which comes into effect June 26, 2025. This has been phased in by classification societies for an inventory of environmentally and physically hazardous substances including asbestos, heavy metals, hydrocarbons, and ozone depleting substances. The inventory is made on newly constructed vessels and of those currently in service. These inspection reviews continue at the time of mandatory renewal surveys and prior to the scrapping of the vessel.

I couldn’t find a list of the compliant scrapping yards but have been reading news of yards in the Pakistan/India scrapping regions becoming compliant and having some pressure from vessel owners. Turkey was the first country in the European region to have compliant scrapping yards.

The year 2025 will not be thrifty for the marine industry while possibly some offsets by the success of the rates for some sectors. Some of the charter rates may be improved by shippers contributing to the operation of vessels they need by paying more into the charters. There are also some improvements in the construction and operation of vessels that will aid in reducing fuel consumption.

Clarksons Research state that 29.1% of the current fleet uses exhaust scrubbers and 25.7% of the orderbook, in Gross Tons, new ships will come with scrubbers. This is year five of the IMO global sulfur cap regulation and the exhaust scrubbers created to avoid the high cost of Very Low Sulfur Fuel Oil (VLSFO).

The cost for such an installation in 2020 was $1.3MM and taking 4 to 6 weeks. The current cost is in the range of $800,000 and with quicker installation.

This has always been played off against the cost of VLSFO. In January 2020 VLSFO was at $649 per tonne, cheaper than the cost of the scrubber installation but with this fuel hard to locate. In January 2022, VLSFO was $1,084.5 per tonne making the scrubbers attractive. In March 2024, the fuel was down to $664.5 per tonne. This varying fuel rate may be why only about a third of the fleet now are equipped with a scrubber system.

The future doesn’t look too bright for the future of scrubbers. The scrubber systems use water along with chemicals to clean up the diesel exhaust. One system circulates sea water within the system while in port and discharges the tainted wastewater at sea. The simpler system discharges the wastewater as it is used. Years of study have shown the wastewater contains something toxic called polycyclic aromatic hydrocarbons (PAH). The wastewater from the closed system had higher PAH than that of the open system. Based on this toxic effect, a few countries are already planning on denying the use of scrubbers in their ports and national waters.

Compliance strategies currently rely on dual-fuel engines using LPG or LNG. However, as emission limits tighten, these systems may no longer suffice by 2040. Biofuels derived from non-food sources, such as animal fats and waste oil, will play a more significant role.

Wind-Assisted Propulsion

Keep in mind that for most ocean service vessels, fuel is at least 60% of annual costs. The more you burn, the more it hits you in many different ways.

Fuel saving systems continue to grow with the potential of various wind systems. The choice among various types of wind assist systems and various alternative fuel choices make things difficult for owners planning the design and operation of new vessels.

There are now four most acceptable choices in wind-assisted propulsion systems. They are Flettner rotors (rotor sails), wing sails, suction sails, and soft sails.

Flettner rotor sails, Adobe Stock Image

The oldest and most traditional are the soft sails. As before, they consist of mast, booms, and sails made of a choice among many different fabrics. Instead of brawny crew, the sails are adjusted via winches that are controlled by a computer system which reads wind, seas, and the vessel’s speed and motions to adjust the sail positions. While soft sails are flexible and can be stowed, they need maintenance and take up deck space when in use. Their efficiency will vary by wind direction and the vessel’s structure.

A second system, now 100 years old, is the Flettner rotor sails. This is a smooth vertical cylinder with disk end plates. It rotates around its vertical axis producing the Magnus effect. Air at right angles to it causes aerodynamic force in the direction perpendicular to the long axis and the wind flow. A ship with Flettner rotors crossed the Atlantic in 1925.

They are compact and of low maintenance and excellent with winds from behind the midships of the vessel but very reduced efficiency in headwinds. They are now ships with one to three of these in use onboard.

There are two variations of the use of what are called modern sails. They are the wind sail and the suction wing.

A wind sail is rigid airfoiled shaped similar to that of an airplane wing. The wind energy through aerodynamic principles creates a lift which produces propulsive force. However, since they are large structures which have a large wind surface area, they are therefore under heavy stress in strong winds.

Suction wings are similar to wind wings. Their shape creates a low-pressure zone on the wing surface which brings increased lift and increased thrust. They, like rotors, can be folded down for clearance under bridges or during cargo operations but are not as efficient downwind and are noisy.

The wind and wing sails are being constructed of many experimental synthetic materials, so their maintenance will be determined as each material is in use.

The choice in wind assist will be determined by the type of vessel, its operating routes, desired performance, and how they will fit into historic wind conditions.

Inland

The forecast for future agriculture exports continues to grow. The 2024-2025 marketing year has shown growth since the harvesting time and the month of September. For corn, the expected growth over the 2023-2024 season will be 8.0 percent. This is due to a large growth of sales to China through an agreement ending a brief trade war. How this will continue in 2025 is yet to be seen. For now, it is the second largest corn export in recorded history.

Adobe Stock Image

Soybean exports are showing a 7.7 percent growth over the previous season. But export commitments can vary with the unshipped commitments. Buyers can watch the production and the prices of grains from other agricultural countries like the ones in South America or Ukraine.

There is also a change in soybean oil exports. USDA is projecting that it may almost double. Much of this growth in exports appears to be that production growth in soybeans that has in the past been absorbed by the U.S. biofuels industry has fallen off. Either way this growth is good for the operators of tank barges.

The hot summer has increased the need of electrical power; therefore, having the coal fired power plants burning more coal. But much of this has been out of the stock that was built during the Ukraine market shock. They have not needed much additional coal and have been affected by the drop in the cost of LNG. Favorable LNG prices are expected to continue. There was also a growth of 30.7% in utility power generation from the 3rd quarter 2024 to 3rd quarter 2024 from solar fields.

As 2025 unfolds, the maritime industry faces rising costs, evolving environmental regulations, and geopolitical challenges. While some sectors may benefit from higher rates, others will need to adapt to stricter emissions standards, technological advancements, and fluctuating market conditions. Fuel-saving systems and alternative energy sources will be crucial for long-term success.

-Norman Laskay

If you’d like to keep this conversation going, please email me at nlaskay@DLSmarine.com`