- July 19, 2022

- Industry, Marine News

- Another Look at the Fuel Gauge

“You gotta risk it to get the biscuit.”

-Anonymous

First, a look at the current leader, LNG. Even though the World Bank came out against LNG encouraging owners to skip LNG and concentrate on hydrogen-based fuels. We’ll get into hydrogen as a fuel later in this edition. The World Bank’s reasoning is that LNG is not that clean because of methane slip. Methane slip is not a term we hear too often.

Methane is a byproduct of oil and gas production. Methane can be 85% or more of LNG. In LNG powered engines, including land-based transportation powered by LNG, some of the methane in LNG slips past a piston, some through the crankcase, and some remains unburned-and this is called methane slip. While LNG is much cleaner than standard fossil fuels in the reduction of CO2, the methane byproduct is worse. One kilogram of methane (CH4) in the atmosphere is equal to 84 grams of CO2.

SEA-LNG, a group that is a “multi-sector industry coalition”, of course pushed back. They counter that engine manufacturers continue to design engines that are cleaner and more efficient that will greatly reduce methane slip. They believe methane slip levels will be “minimal” by 2030. Some LNG fueled ships are being fitted with catalyst systems for the engine exhausts. Bio-LNG will also be a possible solution as GHG will be reduced in the creation and in the use of such LNG.

The bet hedging is shown by the number of ships now being built and ordered to run on LNG and a second cleaner fuel. A short-term benefit for LNG is that, as of now, methane slip is not used in a ship’s EEXI and CII calculations.

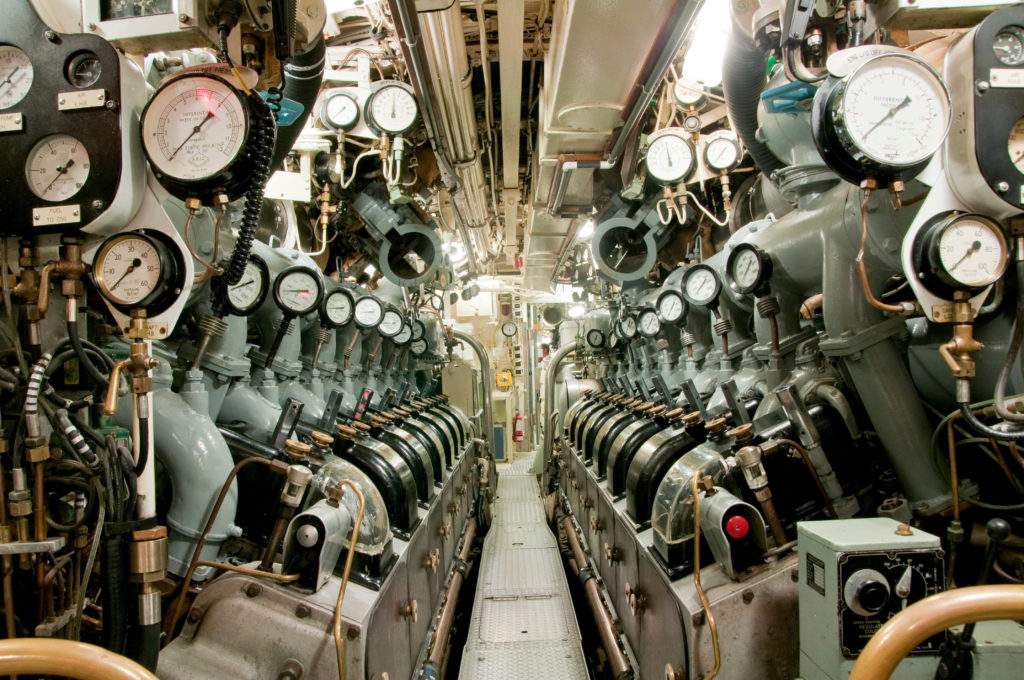

The engine game to burn new fuels is complicated. There are so many variables: four‑stroke and two-stroke diesel engines, high, medium, and low speed, large bore and small bore, and usage for main propulsion through a marine gear or diesel electric or for generator or other auxiliary power. Different fuels also have different viscosities and energy densities calling on different delivery systems which also may have to have multiple safety systems. These fuels also react differently with seals and gaskets and have differing levels of effects on engine lubrication. These factors certainly run up the cost of the engines and a vessel’s design to store such fuels and lubes. All costs that are on top of the cost of the new fuels.

While the cost of some new fuels will drop over the next 20 years, for now, no one knows which fuel(s) will be the cheaper to buy and to utilize in the future. Currently, only the owners of LNG and ammonia tankers, who can burn their cargo as fuel, are free of the concern as to what fuel or fuels will be the winner as to accessibility and meeting the emission deadlines of 2030 and 2050.

LNG and ammonia work more efficiently in the bigger engines used by the largest ships. The fuels of interest for small four-cycle engines offshore and inland transportation seems to be methanol and biofuels.

Hydrogen

Det Norske Veritas (DNV) has recently put out a 114-page study, “Hydrogen Forecast to 2050”. It goes into extensive detail on the national players and regional economics of hydrogen production and use towards the 2050 goal of zero-emissions. I’ve pulled out some of the highlights that I thought would be informative. These highlights are not totally about hydrogen and ocean shipping. While hydrogen is an important world fuel for the future, it is not immediately in line for most shipping purposes but of interest to those involved with other forms of transport and power generation.

By world calculations, hydrogen would have to be 15% of the global energy demand by 2050 to meet the desired reduction in GHG; however, DNV believes it will only reach 5%. By 2050, $6.8 trillion dollars will be spent on producing hydrogen, not including an estimated $180 billion to be spent on hydrogen pipelines and another $530 billion for building and operating ammonia terminals.

Why is there ammonia in a hydrogen program? Green hydrogen will be used to produce derivatives like ammonia, methanol, and e-kerosene which will become common in about 10-15 years for heavy commercial transport such as some trucks, aviation, and select marine assets.

Starting in the late 2020’s, iron and steel and other high temperature processes will replace coal and gas. To feed these and other facilities, 50% to 80% of existing gas pipelines worldwide will be converted to methane. It is much cheaper to convert existing pipelines than to start the new process of accessing land, digging and developing rights‑of‑way. Intercontinental trade in methane and ammonia will be by ships, large and small.

While powering things with hydrogen is much cleaner than fossil fuels, hydrogen is not natural and must be created, usually through the process of electrolysis.

Green hydrogen is when the electrolysis is done with power from renewable sources such as wind, solar, or hydropower; therefore, expansion of green hydrogen plants is planned. The earliest pioneers in this branch of new fuels already exist with small plants near wind farms.

Blue hydrogen is made with the use of natural gas in a more “mechanical” process that produces hydrogen, but with a byproduct of CO2 rather than water. This CO2 is injected into the earth or otherwise transported for a secondary purpose. Obviously, with the extra steps, this process in the cradle-to-grave (or as we would say in our industry, “well to wake”) measurement of air pollution is not as clean as green hydrogen.

Both blue and green hydrogen are currently expensive with blue hydrogen being cheaper in areas with natural gas sources, but both expected to cost about the same in a decade. As a side note, there are also pink, turquoise, yellow, and grey hydrogen as well as hydrogen producing ammonia and methane via the Sabatier and/or the Sabatier/Fischer‑Tropsch methods.

While this blog is concerned with the maritime industry, when it comes to fuels, both ships and aircraft are not connected to the grid and are not suitable for hydrogen propulsion. The hydrogen density of pure hydrogen is too low; therefore, fuel tanks would have to be large, making the larger amounts of fuel needed too heavy for use in ships or planes.

By 2040, DNV sees the future use of hydrogen to produce synthetic kerosene (av-gas) for aviation. For shipping, pure hydrogen could be used for shipboard hybrid diesel and gasoline engines. Hydrogen can be stored under very high pressure or at very low temperatures as a cryogenic liquid.

Methanol and Ammonia

Methanol and ammonia are fuels, along with LNG, that are most often discussed and researched for dual-fuel engines. Dual-fuel engines use normal heavy or light liquid fuel oils along with a gas. On some smaller engines, like Cummins diesels, both diesel oil and LNG are used together. Cummins has a kit where dual-fuel capabilities can be added to current engines. On larger ships, a gas and gasoil (diesel) can be used, with the gasoil as a pilot-fuel for the gas. Other systems have the gas used for ocean steaming and the engine changed over to fuel oil when approaching a port or other maneuvering area. The newest engines have dual injectors that automatically change with the desired fuel needed so that the fuel amount supplied to the engine balances the power density of the fuel.

A measure of the complexity of the issue, MAN, a marine engine manufacturer, has a dual-fuel ammonia burning engine in R&D. It will be a single cylinder large bore two‑stroke engine. As a single cylinder, all the processes can be carried out and tested at an acceptable cost. But this leaves us with questions: is this even efficient? What safety measures are necessary? What will be the percentage of pilot-fuel necessary during operation and how will that change with different pilot-fuels, such as diesel vs biodiesel, while falling within required emission standards on other emissions such as nitrous oxide? Then, once it is finished, would such an engine be affordable? Will there be any demand as it will be vying against engine competitors and other fuel types?

All competitors are working on “future proof” engines that will work with any fuel, be highly efficient to burn less fuel of any type, have minimal methane slip, BE highly modular, and have advanced computer systems that can control dual injectors, intake, separate exhaust valves, and metered demand through dual turbochargers.

With these complex engines, I foresee autonomous ships with three deck crew and four maintenance engineers (at least one being a software engineer). I imagine the captain/navigating officer may be able to work from land.

Safety

I mentioned above that one of the factors to be studied on the MAN experimental engine was safety. “Together in Safety” is a non-regulatory consortium of industry players that includes AP Moller – Maersk AS, Australian Maritime Safety Authority, BIMCO, Carnival Corporation & plc, Cruise Lines International Association, Danish Maritime Authority, Euronav, Gaslog, Global Maritime Forum, INTERCARGO, Interferry, International Chamber of Shipping, INTERTANKO, Lloyds Register, MSC Group, OCIMF, Thomas Miller, Shell Shipping & Maritime, UK P&I Club, and V.Group.

Nine of these members conducted a basic risk assessment study on the maritime use of LNG, hydrogen, methanol, and ammonia. The study is limited as it is not practical, maybe impossible, to match every fuel with every possible accident that could happen on every ship type. The study does, however, point out possible problems with each fuel type.

Generally, the risk level is lowest with methanol, followed by LNG, hydrogen, and ammonia. While methanol is considered “safe” as a familiar cargo, just like LNG and ammonia, it is kept at ambient temperatures with a dangerously low flash point. Unlike methanol, hydrogen and ammonia have not been used in the past as fuels, so there are no current regulations on their use in this capacity.

Currently, there are dual-fuel ships being built to run on hydrogen . Because of this, class societies have drawn up and approved designs for their safe loading, storage, and fuel use. Engines have yet to be built to run on ammonia, but class societies have drafted regulations for the construction of such ships with owners/shipyards planning future conversions of existing engines and fuel systems to operate with ammonia.

Manufacturers and shipyards believe conversions/retrofitting will be a growth business over the next ten years as fuel supply and demand numbers and costs shake out.

For those that might want to look deeper into the makeup of the safety study and its findings go to:

https://safety4sea.com/wp-content/uploads/2022/06/Together-in-Safety-Future-Fuels-Report-2022_06.pdf

While this study is for seaborn risks, the basic risks of these fuels will be the same for storage and use with land facilities, such as future power plants and factories.

Use of LNG as part of dual-fuel operations is getting more common in blue water and now brown water service. The other fuels, like their engines, are still at an experimental stage with a few Beta vessels. It will be five to ten years before these vessels will be more common as they not only have to be proven as safe, economical, and ecologically acceptable, but fuel manufacturing and distribution needs to be built out worldwide. Some of this will be helped by learning from the growth of LNG use in waterborne transportation of commercial cargos.

Here at DLS, we are working to have our field surveyors educated on the safe bunkering and storage of new fuels including hydrogen. We have already drawn up basic inspection steps for LNG systems.

The possible future of some Jones Act PSVs

Maersk’s offshore division, Maersk Supply Service, has finished the conversion of a 2018‑built Anchor Handling Tug Supply Vessel (AHTS) to an electric hybrid. The MAERSK MINDER is a 4,905 DWT Norwegian-built vessel of 23,856-HP and a Bollard Pull of 270 MT. There are eight peer vessels owned by Maersk for North Sea use or another operating company for use off Brazil.

The conversion took short of three months with the hybrid power system being a containerized unit and fitted at the aft end of the main deck house. The system contained what is seen in electrical hybrids, a multi-battery storage system, in this case, 132 batteries, and a computerized energy management system working through a transformer.

The point of the exercise was to reduce fuel use and emissions. The surge power benefits of batteries work well with the vessel’s job of rig towing and anchor handling.

Will this be seen in the U.S.? Maybe not. The MAERSK MINDER is a nearly new, very powerful, and very expensive vessel. The cost-to-cure emissions-driven economical depreciation may not be worth it.

Harvey Gulf and Chouest have some hybrid vessels, but they are tied in with contracts that help pay the cost. Maersk can source funding from its container liner services so they have the means to experiment and upgrade. In addition to the partial change to battery power, they also added a ballast water treatment system and a catalytic reduction system (urea) to the engine exhaust, further raising their green bona-fides.

There is more than one way to skin a green cat

A company in New Hampshire HAS jumped on the green express.

The green crab is an invasive species that destroys commercial shellfish on both coasts. Attempts to make them popular as a food source have been unsuccessful so Tamworth Distillery with the University of New Hampshire Green Crab Project, boiled the crabs into a stock, added spices, and blended it with Tamworth’s bourbon to produce the boutique “Crab Trapper” whisky.

Reviews are good for those who like “Fireball” type whiskies. It’s not cheap but you’re helping the planet. Is a zebra mussel vodka or tequila next?

-Norm Laskay

If you’d like to keep this conversation going, email me at nlaskay@DLSmarine.com