- March 6, 2024

- Industry, Marine News

- Hot Air?

U.S. Offshore Wind and An Ongoing Look at Inland

“The answer, my friend, is blowin’ in the wind”

-Bob Dylan

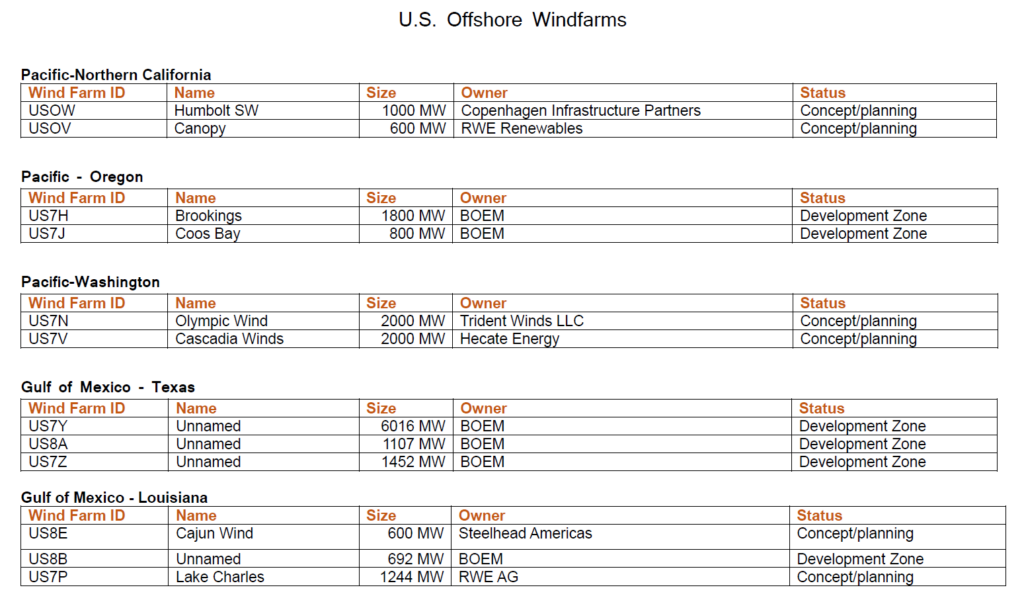

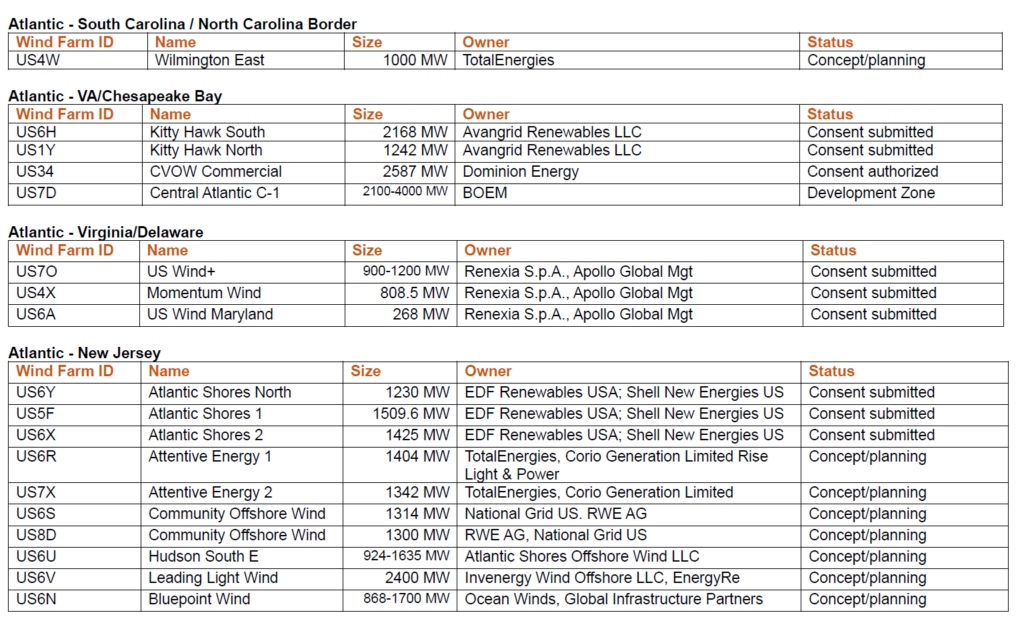

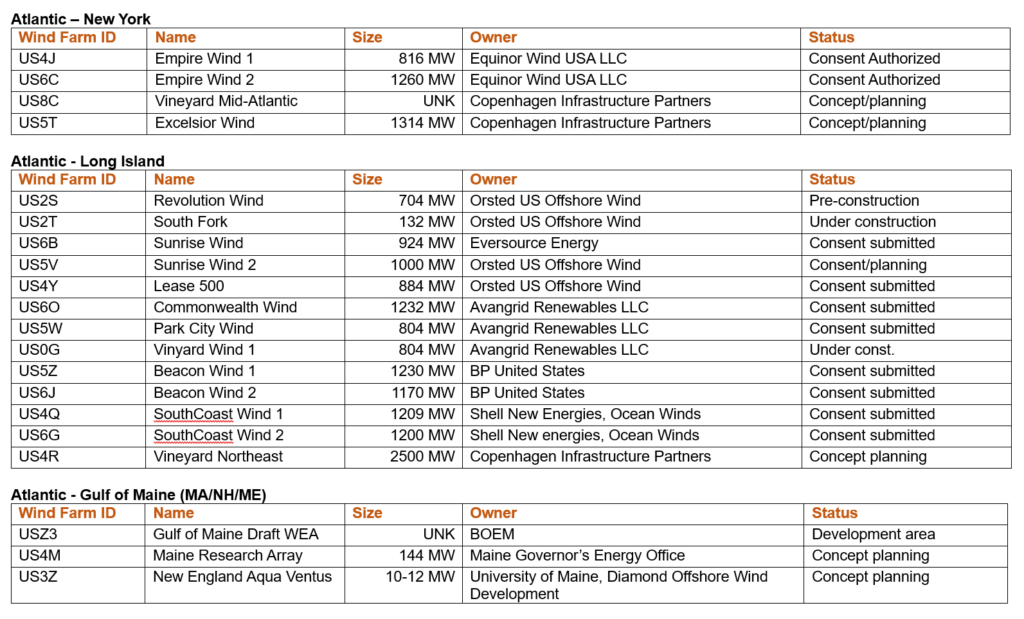

U.S. offshore wind farms come up frequently in the news, often related to politics and with a list of players that seems to change monthly. The number and location of sites in this industry, fledgling in the U.S., is confusing. To help visualize what is happening, I found several websites with information on the U.S. Windfarms operators. I created a “U.S. Offshore Windfarms” table found below, listing each wind farm by its coastal location to include its development status as of mid-February 2024.

Creating an Offshore Wind Farm

The U.S. government offers offshore zones for development through a bidding process similar to what is done with offshore oil sites. Once a bid is accepted, the owners go through a concept and early planning phase. Of great importance is the research into its feasibility to include understanding the seasonal wind patterns, the water depth and currents, the seabed condition for turbine towers, the distance to shore to determine the need of substations. The application will have to contain, among other things, an environmental assessment of ecological, marine, and coastal impact. The consent application is then submitted to permitting authorities. When an application is accepted and consent received, construction can begin.

One can see that the process is long. It is possible that some may never be created and probable that others will look different in ownership and/or design from the original concept.

Inland Market Update

Overall, the grain market is unchanged. While the U.S. yield in corn has been raised by the USDA, due to higher per acre yield, the existing/scheduled export amounts have minimal change. However, they do continue to be higher than last year. Currently, the biggest consumer of U.S. corn is the U.S. because of the money invested in ethanol fuel. Argentina and Brazil follow, with Brazil also heavily invested in biofuels.

Soybean yield is slightly higher than estimated, but the forecast for exports is unchanged and 11.9% below 2022 exports. The biggest buyer by far is Brazil at twice the amount of the second user, the U.S. The export totals are down mainly due to tariff disputes with China.

Hopper barge utilization may depend on bushel prices and the possibility of farmers storing part of their crops, awaiting better prices.

Next year, the USDA believes farmers will transfer some fields from corn to soya beans. While corn acreage will drop, the yield is expected to grow so available corn for 2024-2025 will be steady. The 2024 export of corn and soybeans is expected to be good, as part of it will be a carryover of the 2023 crop. With large volume, prices are expected to drop a bit and make U.S crop exports more attractive.

The wheat trade is not a big factor in the inland river trade, but knowing the players can be entertaining. Wheat is the largest agricultural product in the U.S., but ironically, the U.S. is not one of the top five consumers. By far, the largest buyer is Russia followed by the EU, probably due to the shut off from the large Ukraine wheat harvest. The importation of U.S. corn to Russia and the Ukraine is up only slightly since pre-war.

Outside of the grain market, steam coal exports are down 7.4% YTD 2022. Metallurgical coal is up 1.6% with China as the largest buyer.

Northbound imports were down in the 4th quarter 2023. Cement was down, possibly due to the drop in new home construction. Imported steel and fertilizer were also down with the latter possibly due to seasonal needs. The biggest drop was in the importation of alumina and bauxite as a number of aluminum plants have closed or partially closed some of their production lines starting in 2022.

Inland new barge construction, dry and liquid

There were 318 new hopper barges built in 2023. In 2016, 1,000 new barges were built, and that number has continued falling each year. New construction in 2022 was depressed by steel costs. The cost of steel plate has dropped but also barge construction has become somewhat more affordable due to the growing acceptance of hot rolled coil steel. Time will tell if this new steel construction method holds up to inland river service.

These new barges have come from two sources. Arcosa Marine Products, ex Trinity Marine Products, and Heartland Fabrication, ex Brownsville Marine Products. Most are for the listed buyer, but many were purchased to be leased.

Company | Order | Builder |

Heartland Barge Mgmt. | 121 covered | Heartland |

Heartland Barge Mgmt. | 30 covered | Arcosa |

Campbell | 54 open | Arcosa |

Crounse | 40 open | Arcosa |

Parker Towing | 31 covered | Arcosa |

(9 more of the Parker order are slated for 2024 delivery) | ||

CIBCO Barge Line | 25 covered | Arcosa |

St. Paul Barge Line | 6 covered | Arcosa |

JEM Transport | 5 covered | Arcosa |

M/G Transport | 4 covered | Arcosa |

RTI Barge Management | 2 covered | Arcosa |

This is what River Transport News (RTN) researched for inland tank barge deliveries in 2023:

Seven companies ordered 26 new barges for 2023 compared to eight companies that ordered 22 tank barges in 2022. Despite the larger number of new units, their aggregate volume was lower in 2023 as many of the barges built were of smaller capacity. According to RTN, this was the lowest aggregate capacity year since they started their research in 1990. The probable cause of this drop was that current rates did not justify the costs of new construction. Some of the new barges were built for special service which may have rates/charters that justified their construction.

Company | Quantity | Size | Type | Builder |

ACBL | 10 | 10,000 bbl | Chem | Arcosa |

Kirby | 4 | 16,000 bbl | Pressure | Conrad |

1 | 10,000 bbl | S/S tanks | Southwest S/Y | |

Enterprise Marine | 2 | 30,000 bbl | clean | West Gulf Marine |

2 | 30,000 bbl | heated | West Gulf Marine | |

Cenac Marine | 2 | 30,000 bbl | Clean | West Gulf Marine |

Southern Duvall | 2 | 30,000 bbl | Clean | Conrad |

Superior Bay Marine | 2 | 30,000 bbl | Clean | Conrad |

Carline | 1 | 10,000 bbl | Clean | Southwest S/Y |

RTN research believes that there will be little change in tank barge deliveries in 2024 from the 2022-2023 level.

Kirby’s 4th Qtr. report anticipates some revenue growth in 2024 due to increases in rates. The 2021-2023 numbers given in this report indicate that Ton Miles revenue and Operating Margin are up. We will look at Kirby and others after their 2023 10-K reports are released.

Drones

DLS has used drones and an in-house designed ROV since 2018. We were the first independent marine survey company to be certified by the American Bureau of Shipping for external digital inspections. During COVID, when traveling was restricted, we were able to conduct external inspections of two vessels in Scotland using drone technology.

More recently, we have done preliminary test inspections of the first operating wind turbines in Dominion Energy’s field off the coast of Virginia by drone.

Earlier this week, I sat in on a meeting and witnessed the first sample of a visual report that DLS is working on. This software allows anyone to see a vessel through the eyes of a marine surveyor conducting an inspection. Using a mouse, one can move forward and backwards, left and right, up and down, 360 degrees, and zoom, just as if the viewer was the inspector. Future inspections can be compared side by side with prior inspections to look for changes. This is very helpful in detecting or tracking damage. Measurements for damage or litigation can be done on screen in U.S. or Metric units.

The aerial inspection of the vessel is done with a drone, now with a high-resolution camera. The onboard walkthrough is done with a 360-degree camera. While the eye is the camera, the brains are the attending DLS surveyors. The surveyor directs the drone operations to fit the purpose of the inspection. It might be for an appraisal, damage survey, litigation, or insurance. Our UAV specialist, Charles Sterling, can remotely control/position the camera, monitoring the video feed in real time as one sees with ROVs.

DLS is now looking into different platforms where our digital walkthrough can be merged with additional data about each vessel such as the ship’s general arrangement drawings. High resolution photographs taken by the attending surveyor can then be inserted as a layer on these documents to draw attention to points of importance. DLS will have our introductory digital survey offering in Q2 2024.

-Norman Laskay

If you’d like to keep this conversation going, please email me at nlaskay@DLSmarine.com