- October 14, 2024

- Industry, Marine News

- Methanol: A Look at Owner’s Alternatives for Greening and the Movement of Bulk Cargoes throughout the World

“Clean energy will increasingly become a source of geopolitical competition, we think, benefiting those who can control and access it.”

Blackrock mid-year Geopolitical Update

Methanol

Methanol has become the most popular alternative fuel for vessels in the global new build orderbook alongside LNG, but its high cost has kept operators from signing up for the fuel in the long term. The industrialization of technology and the commercial development for vessel fueling did not progress as quickly as expected. Owners also take issue with long-term fueling contracts written at prices that fit the prospective building/operating cost of the vessels. Despite this, a reported 46% of vessel owners are still investing in methanol on their vessels.

As investment in methanol increases, the number of owners investing in LNG is now down 25% since 2021. This drop was expected. LNG was a popular short-term solution to meet desired exhaust emissions reductions from a readily obtainable fuel. But as “better, cleaner” fuels become more available, the side emissions of LNG reduce its desirability for total GHG reduction.

The world’s rivers are lined with industries that produce or need the supply of methanol for their products. Maritime Partners’ HYDROGEN ONE is a towboat that moves tank barges on the Mississippi River. This innovative vessel takes methanol and converts it to hydrogen on board. Many of the chemical plants on the river use methanol delivered mostly by barge. It can be available at designated sites to fuel boats powered by similar systems.

An SMM Maritime Industry Report comparing 2021 to 2023 showed the increase in owner’s interest in methanol. Shipyards still preferred LNG and hybrids as that is where their current contracts lie. This is also true of suppliers of the fuels. The interest in methanol has caused the makers of ship engines to develop engines that can dual fuel run with methanol. Their studies are also on high-speed diesels that can be used on tugs and as generators. Reportedly, there will be 300 methanol fueled vessels in operation by 2027.

We can already see the use of methanol increasing globally. The Dutch company, OCI Global, has been purchased by the Canadian Methanex , which includes two methanol plants in Beaumont, Texas. Trinidad and Tobago, located near shipping routes through the Caribbean, has started fueling several tankers with a 20% green and 80% conventional fuel methanol blend.

Keep in mind, for methanol to be the cleanest by the well-to-wake measurement, it should be produced through renewable feedstocks, such as agricultural, industrial, or municipal waste and through renewable electricity for the desired Green Methanol. As clean as it can be with the proper e-methanol process, I have previously mentioned its problem with safe storage and its low power density. For at least the next five years, fuel producers will continue to make alternative fuels greener, and users will continue to make its on board use safer, and of course, less expensive.

However, building new ships is extremely expensive. It is not only the cost of all that goes into the new construction, but the fact that the surge of new orders in many fields has overwhelmed available shipyards. There is no room for hard price negotiations.

Owner’s Alternatives

Owners of vessels that need to improve their GHG emission statistics under IMO regulations have more readily, and more economically, moved to other routes.

I find it amazing that the propeller has had the most advances and changes. Propellor ducts, pre-swirl stators, rudder bulbs, and other energy saving devices are in use or on order for over 11,000 vessels. Fuel handling systems for dual fuels and waste heat recovery systems are in use or on order for 320 vessels as these are still a new field.

Deck mounted wind assist outfitting, such as Flettner rotors, suction wings, kites, and rigid sails, are on more than 100 vessels. Such systems are expensive but quicker to install—reducing downtime. There are additional hull factors that may cost more and require longer installation times. Well known bow designs, such as the Ulstein X-Bow and the Damen Sea Axe, can increase efficiency. Air lubrication systems have also been growing in popularity, as are hull fins, including a whale like flipper, and Elogrid, which is a system to efficiently operate any side thrusters. Adding up all the vessels in use or being built, there are over 3700 vessels using one or more of these changes, most with efficient bow designs.

These design variations have been a factor in ship design and retrofitting since around 2000 and will be more common in this decade. A ship may now have two or three of these along with dual or single alternate fuel engines, all to best meet the IMO CII standards, often just for their trade route. Once sales start clarifying, the market owners, lenders, underwriters, and appraisers should see which CII grades support a favorable value of that ship type. There will also be the factor of the cost of maintenance of some of these advancements. While a ship with a good CII grade will be popular with users and helpful with getting good charters, an owner is still faced with the risk of their income not exceeding expenses.

Maritime Dry and Liquid Bulk Sectors

Right now, the dry bulk sector is very strong and thriving on high rates. These are the large ships carrying coal, iron ore, and bauxite for the needs of China. Tonne mileage is higher because of current necessary diversions due to political situations and port congestion in loading and discharge ports. Areas producing steel may be changing in the future to areas that have green renewable power that will draw the construction of efficient and cleaner steel mills.

A group caught in the squeeze are the smaller sub-Panamax vessels, which are carriers of most of the world’s cargo, raw and semi-finished materials. These dry bulk carriers comprise 63% of the dry bulk fleet and are operated by most of the small vessel owners or operators. These owners may want to comply, but this can raise their operational costs without a benefit to their balance sheet. Also, the required energy transition between 2030-2050 is projected to cause a decline in the need for the carbon intensive cargo types that are the base of the income of many of these operators.

Currently, owners and operators have no incentives to build new ships because of the high level of utilization providing excellent profits for a fleet of the current size. Simple supply and demand. There is difficulty in finding available builders at reasonable cost which keeps these owners away from new construction and added debt. Shipyards are booked out as much as four years ahead with the construction of container ships, LNG/Ammonia/Methanol ships, and product tankers. Producers and trading houses of bulk cargoes are under pressure to control emissions, but understandably, they feel these added costs should fall on the vessel, and not add to their cargo shipping costs.

The international coal demand is still good. Part of that is China’s demand of coal to produce electricity to make the electric cars that they are pushing on their population. China has the world’s largest program to move to renewable power, particularly via windfarms, but that will take more years to succeed. The political situation affecting tonne miles is also good for carrying coal. However, executives in this area of marine shipping and other commodity experts believe the need for coal will peak in the early 2030s.

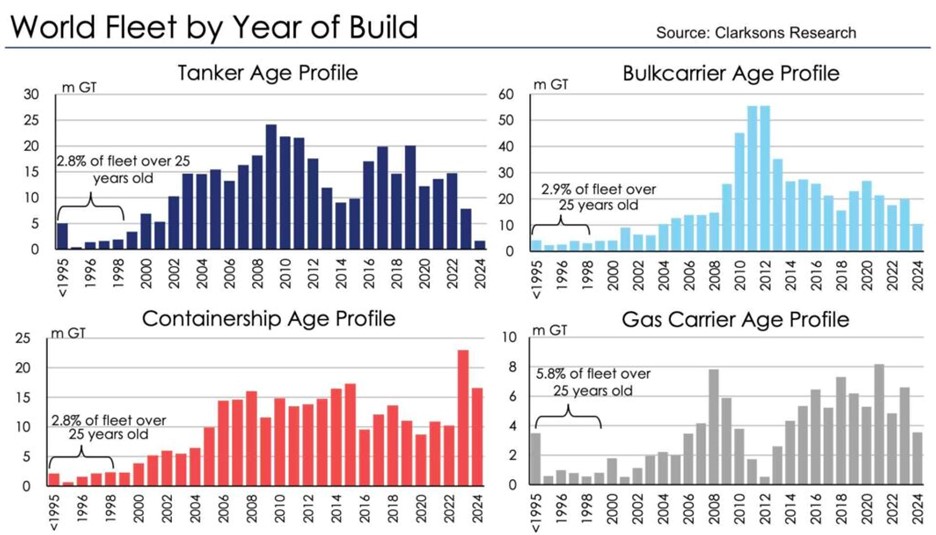

Large bulk carrier owners state that after their building boom between 2000 – 2011, the fleet is easing into their 20-year age. It is interesting that the owners of tankers are looking at a similar situation. They do not want to get into the high costs of new construction and believe that it will be possible to have users move from the 15-year desired charterer age limit to twenty years or higher. They are also wary of new construction contracts at this time due to a weakening demand for crude oil as the move to alternate fuels grow and because of world geopolitics and “operational complexity” that may occur depending on the outcome of the U.S. presidential election in November.

Increasing costs and regulations are making a worldwide impact, particularly on small vessel operators. Domestically speaking, a small family size operator of tugs, pushboats, and oilfield vessels may have financial problems complying with the load of new regulations, tired of the treadmill or unable to keep up with the changes in domestic and international commerce.

As seen in the charts above, newbuild orders for tankers and bulk carriers are rare, while shipyards are deeply stocked with orders for containerships and gas carriers. And there is a projection that container rates will go into a fall running into 2025 due to a projected easing of demand assisted by an over-built container fleet.

There is a clear effort by owners and operators in the shipping sector to meet emissions requirements, from transitioning to alternative fuels, such as methane, to rethinking ship design elements for green optimization. This all while facing higher construction and labor costs while potentially decreasing profit margins.

As said by King Mongkut of Siam (or was it Rodgers and Hammerstein?) “tis a puzzlement”.

-Norman Laskay

If you’d like to keep this conversation going, please email me at nlaskay@DLSmarine.com