- April 4, 2022

- Industry, Marine News

- MY GREEN IS BETTER THAN YOUR GREEN

Old MacDonald had a ship EEOI, EEXI OH!

And on that ship he had a SEEMP, EEOI, EEXI OH!

With an AER here and a CII there, there are lists that seem to swarm

Everywhere a bloody form

Old MacDonald had a ship…until he didn’t

-ANON

I’ve been writing a lot about the ecological movement and the greening of merchant ships. DLS Marine is deeply involved in the appraisal side of the marine survey business and a good number of the readers of this blog are involved in maritime lending or insurance. The greening of the world’s fleet involves huge amounts of money.

Money is needed for research and development in ship construction, for the design and construction of much of the equipment that goes into a ship, and for the possible future designs and equipment that will be necessary to meet greenhouse gas reduction goals. This demand is being driven by regulations from international bodies and by marketing pressures from lenders, insurance companies, and even the manufacturers that use ships to carry their raw materials to manufacturing sites and completed products to the world’s market places.

Once regulations and market demands force you to become green, how will your level of greenness be measured? This edition will look at the measurement systems created by various authorities and the problems they may foreshadow.

At the last meeting of the IMO Marine Environmental Protection Committee MEPC-77 in 2021, it was agreed that the use of a system for determining the energy efficiency of a ship would be required by the start of 2023. Each ship over 400 GT must produce an approved plan for measuring its Energy Efficiency Existing Ship Index, EEXI, and Carbon Intensity Indicator, CII, in 2023. The rule comes into effect January 1, 2023, and every vessel must have an EEXI/CII plan by its annual inspection date in 2023. If the plan is not in hand by the end of 2023, the vessel’s operating certificates will be revoked.

These calculations are intricate and the main Classification Societies, and even the large ship engine manufacturers, are offering their services to produce the plan for your ship.

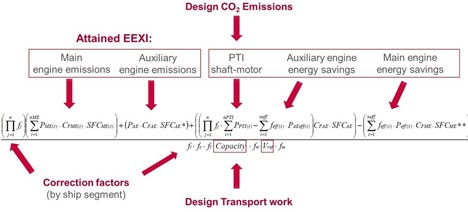

Producing a plan starts with, and is based on, the ship’s EEDI (Energy Efficiency Design Index). This was an IMO regulation that came into effect in 2013 for all new construction. Each ship type and size were given an EEDI, which was a base index point for measuring CO2 emissions for that type and size ship.

The basic formula is an estimate of the grams of CO2 produced per transport work, i.e., the grams of CO2 per tonne-mile. The idea is the ratio of environmental cost (CO2 emissions) divided by the benefit for society (cargo tonnage carried per mile).

The figures are based on the installed power and designed speed (main factors of fuel consumption) and the cargo tonnage carried.

EEDI was the starting index point from which to measure design changes as newer ships were built, and the EEXI will carry this to all operating ships setting a CO2 emissions base index point.

Working with the EEXI is the CII, Carbon Intensity indicator. The first, EEXI, measures the 2023 base index and the latter the ongoing CO2 intensity as a vessel proceeds through its life. The intent is for a ship owner to make the ship cleaner each year through a Ship Energy Efficiency Management Plan (SEEMP) to reach a Required Annual Operational CII for that particular type of ship. CII also has the same effective dates as EEXI but is for ships of 5000 GT and up. It can measure the desired downward trajectory of a ship’s carbon intensity.

These regulations shall be reviewed in 2026. Their goal is to achieve the IMO emissions goal for 2030 of a 40% reduction in global fleet emissions from the 2008 levels which were used as a base.

Based on their individual CII Annual Efficiency Rating (AER), ships will receive a grade from A to E. A and B are at, or close to, compliance and C is the base line. Those that fall below C fall under special rules forcing them towards improved compliance within three years.

I have seen renderings of ships with giant “A” s painted on their superstructure, but I doubt that owners with lesser ratings would carry such a Hester Prynne mark.

Visible or not, having a lower grade may cause (probably will cause) them to be scratched off the use list of charterers and possibly even insurance companies. If an owner can’t bring a vessel into compliance for whatever reason, the vessel will lose its trading certificates. A low grade may also impact their marketability; therefore, their value. Lenders will have second thoughts on financing used ships that may not, for various reasons, be able to be compliant with existing and proposed regulations and will, therefore, become stranded assets.

The regulations do not tell you how to become compliant. Any means of reducing emissions is allowed.

One regulation that has been in use for many years is slow steaming. Just as with an automobile, the faster you go the greater the resistance and the more fuel you burn. The same physics apply to ships. The other routes to carbon reduction cost money, such as burning low sulfur fuel oil, installing scrubbers, modifying hull, rudder, and propellor shape, special hull coatings, wind and electrical assist, and engine conversion to cleaner alternative fuels.

Problem solved? No.

There is a fight by owners against the IMO AER measurement system. The measurements are based on a vessel’s deadweight tonnage (or TEU capacity or Gross Tonnage with ships where capacity is based on volume, like passenger ships) and annual mileage traveled. While larger ships of greater tonnage have bigger engines and burn more fuel, the classic efficiencies of scale (the reason for 20,000 TEU container ships) show that for each tonne carried for each mile, the percentage of fuel burned is lower on that basis.

The problem is that the rule is using the ship’s capacity and not the weight of the actual cargo carried each voyage. On the one hand, a ship that delivers a cargo then returns in ballast (empty) is charged as being full both ways. On the other hand, a ship owner or charterer can play the game and take “the scenic route” to increase the mileage to better the tonne-mileage ratio. This may be worth the extra fuel burned if the charter rate on a D ship is attractive to the charterer and covers the fuel burn.

The European Union, as part of their transport regulations to reduce GHG, produced the EEOI, which is a tool for measurement, but it is not mandated. It is similar to the EEXI except that the calculations are based on the actual tonne miles a vessel does in a set period, a measurement of the actual cargo that was aboard, and a calculation of the efficiency of the fuel being used. As I noted in the last blog, diesel oil, low sulfur fuel oil, LNG, and methanol, all have different power outputs per set measurement (BBL, cubic meter, etc.) so will be emitting differing amounts of pollutants per tonne mile.

Owners aren’t happy with this idea either as it produces a lot more paperwork to track and, on the commerce side, gives away some trade leverage by letting the world know how much cargo one carries in various trades.

The reason the IMO system passed is that a system is needed and the EEXI is the lesser of several evils – and had the votes in a fractured industry.

Regulations are the main propellant of the use of systems to induce operators to operate cleaner ships but not the only one.

OUTSIDE INFLUENCES

The EU as the world leader in the fight against GHG emissions has proposed legislation that would consider the complete shipping value chain, not just the waterborne section, and would therefore hold ship time charterers along with the ship owners responsible for emissions accountability.

Dr. Roar Adland, a professor of shipping at the Norwegian School of Economics, suggested that today, possibly 90% of preventable emissions are set up before a ship is hired to carry a cargo. These are actually commercial drivers such as the specifications and performance of the ship, the ship’s location in reference to where the cargo is to be loaded, the discharge port(s), the efficiencies, or their lack at load/discharge port(s), the performance parameters in the charter party, such as minimum speed (the faster the ship moves the more cargo that can be moved in a set time), all based on money. It comes down to efficiency in the total supply chain, including port efficiencies and even chartering a ship with the shortest ballast transit i.e., running empty of cargo. The efficient ship is a small part of the exercise.

Dr. Adland puts it neatly by saying “Chartering an A-rated ship today is like buying an A-rated fridge and leaving the fridge door open.”

Experts say that continued growth of Artificial Intelligence (AI) can greatly improve port and supply chain efficiency. But what can change trade patterns? Yes, the whole Just-In-Time (JIT) inventory idea is being rethought, but there is still the fact that raw materials are in one part of the world, their need in other parts, and the buyers of finished products in other parts, even from where the raw materials started.

As I mentioned at the top, lenders and insurance companies are involved in greening decisions. Last year in a blog, I talked about the Poseidon Principles. That hasn’t gone away but grown.

For a quick recap, the Poseidon Principles were part of an agreement put together by a group of shipping banks and shipping companies around the world. It was officially started by its signatories 18 June 2019 to make reduction of carbon emissions a target of their ship loan portfolios. It was based on four principles which are meant to gradually move their ship loan portfolios towards greatly reduced GHG emissions. The principles are:

- Assessment: An annual assessment of the carbon intensity of their shipping portfolios using agreed methodology.

- Accountability: Assessment of the carbon intensity of the marine assets in the portfolio by classification societies and IMO approved groups and standards.

- Enforcement: New loan contracts to have standard covenant clauses that will pressure parties to move towards desired standards.

- Transparency: Each signatory will annually post its alignment scores to show where its portfolio annually stands towards the desired goals.

In December of 2020, 15 of 20 signatories posted their results from the first year with 3 successfully aligned and 13 not. In December 2021, 23 of now 29 signatories posted with 11 of 23 in compliance with the current goals.

Under the umbrella of the Poseidon Principles, in October 2020, 31 bulk cargo shippers signed onto a Sea Cargo Charter agreement where their charter parties would include emission reduction covenants. They would operate under four principles very similar in wording to the original Poseidon Principles. Among the 31 were well known names such as Shell, Holcim, Cargill, Total, Cargill, ADM and Bunge.

Most recently, in December 2021, a small number of insurers has also joined as The Poseidon Principles for Marine Insurance. These are mainly hull insurers, Gard, Hellenic Hull, Swiss Re, and Norwegian Hull.

While not strictly marine oriented, the United Nations has gathered all types of world businesses under Net-Zero. There is a Net-Zero Insurance Alliance, Net-Zero Banking Alliance, and numerous other industrial and service alliances, many European based, making reduced emissions part of their ESG programs.

With a possible wide membership, Cargo Owners for Zero Emission Vessels (co-ZEV) was organized by the Aspen Institute in 2020. This is mainly funded by non-profits, NGO’s, and deep pocket individuals interested in moving the supply chain to, not just reduced emissions, but zero-emissions by 2040.

The point of the above is that while the IMO and EU are waving the stick, the money side of the equation is waving the carrot. Rules can force operators towards compliance, but benefits from lenders, insurers, and cargo shipping customers may be a greater incentive for owners to spend to comply.

For several decades in teaching marine asset appraisal to appraisers and marine surveyors I would always mention the very important factor in a ship’s value: Condition, Condition, Condition. While still an important factor, the surveyor and appraiser will now be looking at how the vessel is complying with emission reduction. This is not just to comply with regulations, as smaller vessels and some trades do not have to comply…yet. It is, however, getting obvious that the end users of the asset will be the ones that will vote with their charters and contracts on which vessels benefit them most for both actual service and for showing customers and stockholders their ESG bona fides.

While the A to E grading system will be clearly in the class documents of blue water ships, it will be the aware appraiser of other vessels that will be looking for the value-added Tier 4 engines, diesel-electric power, dual fuel capabilities, hybrid propulsion, and even things such as AI real time monitoring of on board systems.

While all of this should not be a problem domestically with marine companies run by their own staff, lenders should be aware of the possible difficulties with most of the world’s blue water fleet. You may be dealing with the ship owner, but their ships are being operated and cared for by hired shipmanagers. The shipmanagers are not just crewing the vessels but also take care of maintenance and regulatory compliance. If a ship ends up in default on a green loan, charter, or insurance covenant and possible loss of operating certificates, who is to blame, the owner or the contractor?

Staying up with technology is not easy, but it is vital to perform one’s job in today’s world. In DLS Marine’s past, sales and construction costs were handwritten in a big ledger and in 1988, I started a “database” of all appraisal results on 3×5 cards kept in a tin box. Of course, all of that has since been transferred to digital search and retrieval. In 2005 when hurricane Katrina damaged our office and kept us scattered for six months, we went completely mobile where every surveyor could dictate a report and add photographs and send it from the deck of a ship or a dock to a central typing pool where it would be produced by the next available admin assistant, also working remote. When COVID struck, it had little effect as we had been operating in a remote system for almost 15 years with encryption and two factor authentication.

More recently, with the addition of cloud-based software, our staff has instant access to the report process with reports being assembled, including the addition of digital drone photos and videos, invoicing, and swift proofreading and correction by the surveyor/appraiser producer before it goes to QC and on to the customer. SharePoint has also allowed us to create a file for surveyor/appraiser education as information on new equipment and processes can be placed in the file and be accessible to all.

-Norman Laskay

If you’d like to keep this conversation going, please email me at nlaskay@DLSmarine.com