U.S. Shipbuilding Expansion

“Good advice is something a man gives when he is too old to set a bad example.”

—Francois de La Rochefoucauld

This blog highlights the ongoing growth of shipbuilding in the United States, including the increasing involvement of Korean shipbuilders Hanwha Ocean and HD Hyundai.

Hanwha Ocean began operations in 1973 at the Port of Okpo in Geoje, South Gyeongsang Province, South Korea. The company manages 4.9 million square meters in Geoje, including the world’s largest 1-million-ton dock and a 900-ton Goliath crane. In November 2024, Hanwha opened a specialized shipyard in Singapore, followed by preparation for operations in the U.S. in December 2024.

Hanwha Ocean, along with Hanwha Systems, acquired Philly Shipyard in the U.S. and launched Hanwha Philly Shipyard, establishing a strategic presence in the U.S. naval ship market. Drawing from its extensive experience building specialized vessels, Hanwha has achieved notable success in the Maintenance, Repair, and Operations (MRO) sector. In August 2024, it became the first domestic shipyard to secure an MRO contract with the U.S. Navy, maintaining the logistics support vessel WALLY SCHIRRA. The ship was originally new in 2009, with the vessel eventually undergoing six months of vessel updating by the Korean Hanwha Ocean shipyard in 2024. In November 2024, Hanwha also received a contract for the regular maintenance of the 7th Fleet oiler USNS YUKON. Hanwha continues to produce vessels of various designs and sizes and is now expanding its capabilities through its operations in Philadelphia, PA.

HD Hyundai, formerly HD Denya, began in 1972 and includes operations at HD Hyundai Heavy Industries, HD Hyundai Mipo, and Hyundai Samho. While shipbuilding represents just one segment of HD Hyundai’s broad business interests, its U.S. presence is expanding significantly.

In recent years, HD Hyundai has signed memoranda of understanding (MOUs) with Fairbanks Morse Defense, Huntington Ingalls Industries, and Edison Chouest Offshore (ECO) for commercial shipbuilding. As part of its partnership with ECO, HD Hyundai is planning to construct two LNG dual-fueled containerships by 2028, primarily using ECO’s shipyards in Tampa, FL.

U.S. Shipbuilding Growth Initiatives

The foundation for domestic shipbuilding growth began with the Capital Construction Fund (CCF), authorized under 46 USC Chapter 535 (formerly Section 607 of the Merchant Marine Act of 1936). The CCF allows U.S. vessel owners to defer federal income taxes on certain earnings to help finance the construction, acquisition, or reconstruction of U.S.-flagged ships. The program was expanded through the National Defense Authorization Act. By the end of 2023, 136 participants had deposited a total of $2.63 billion into the fund.

In 2025, the U.S. government initiated the executive order “Restoring America’s Maritime Dominance,” introducing several key programs aimed at revitalizing ship construction via the leadership of the White House, Department of Defense, and Congress.

- Strategic Commercial Fleet Program

- Office of Maritime and Industrial Capacity under the National Security Council

- Maritime Action Plan and Maritime Security Trust Fund

- SHIPS for America Act and Building SHIPS in America Act (SHIPS stands for “shipbuilding and harbor infrastructure for prosperity and security of America act”)

These programs involve establishing a Maritime Security Advisor within the White House, forming a Maritime Security Board, and launching workforce and innovation initiatives, such as the U.S. Center for Maritime Innovation and the Maritime Workforce Promotion and Recruitment Campaign.

The primary emphasis of the White House and the Senate will remain on military vessels.

President Trump stated the intent clearly: “To boost our defense industry base, we are also going to resurrect the American shipbuilding industry, including commercial shipbuilding and military shipbuilding.” This statement was supported by a January 2025 plan from the Department of Defense, which was built upon a Congressional initiative from March 2024.

According to the Department of Defense, the projected plan extends through 2054, with a total estimated cost of $40.1 billion in 2024 dollars, including $35.8 billion allocated for new construction. As of 2025, the objective is to initiate the construction of 19 new ships. Specific details on ship types, locations, or budgets have not been disclosed. Expected shipbuilders (primarily military) include Austal USA, General Dynamics NASSCO, Newport News Shipbuilding, Bath Iron Works, Ingalls Shipbuilding, and BAE Systems Southeast.

Strengthening the U.S. Commercial Maritime Sector

The Maritime Administration (MARAD) is focused on revitalizing the commercial shipbuilding sector through tax incentives and fleet development programs under the Maritime Action Plan and the Maritime Security Trust Fund. As of 2023, U.S. shipyards accounted for only 0.1% of global new vessel construction.

The U.S. Senate has noted that only 80 U.S.-flagged vessels currently operate in international trade. Yet an additional 100 U.S.-flagged ships serve routes with American crews in other ocean practice that are not the same as the larger ships in international service. In response, MARAD and Congress are working to expand the commercial fleet, with a goal of over 200 new vessels within the next five years.

It is important to recognize that the U.S. commercial maritime sector also includes operations in Alaska, Hawaii, and Puerto Rico, not just the continental United States.

It is also necessary to understand that the owners and operators in the inland towing industry will also need the help of Washington to achieve their “Restoring America’s Maritime Dominance.”

Personal Perspective and Industry History

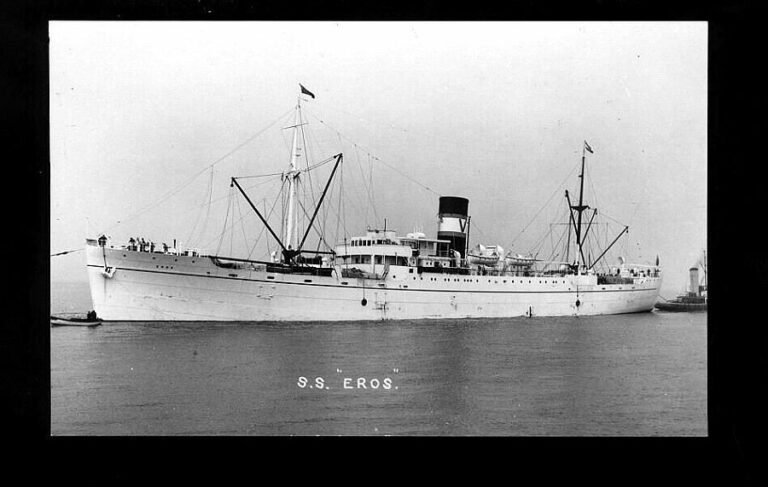

Throughout my career, I had the opportunity to serve on various vessels, including the newer JOSEPH LYKES and the WWII common vessels NORMAN LYKES and WACOSTA. My first licensed vessel was the 1936 SS EROS, a ship that survived two WWII torpedo strikes before continuing its career in Australia from 1962 onward. Over time, I worked with a wide range of vessel and barge operators, shipbuilders, and financial institutions supporting the domestic maritime industry.

Over the 50 years, I’ve been introduced to significant industry leaders, including Canal Barge, McAllister Towing, Main Iron Works, and Bollinger Shipyards. Today, DLS maintains relationships across the country and internationally. Continued collaboration among shipowners, shipyards, and financial institutions is vital to the future growth of U.S. shipbuilding.

There is growing interest in U.S. maritime careers, as seen in the support of state and federal maritime academies. However, many shipbuilding firms are facing labor shortages across all levels, from naval architects to skilled trades. There is optimism, though, as universities are seeing increased enrollment in naval architecture programs and maritime-focused high schools, such as those in Des Moines, Washington, and New York’s Urban Assembly Harbor School. Cities with maritime industries are working to better integrate education, workforce development, and shipyard operations.

Although the momentum is encouraging, policy conflicts within federal agencies are causing delays and uncertainty. There are concerns about declining U.S. cargo exports and a reduced reliance on American-flagged vessels. While military shipbuilding remains a top priority, recent administrative proposals have suggested potential reductions in funding.

Surveys indicate that American workers broadly support a resurgence in domestic manufacturing. However, less than 20% express interest in careers directly related to shipbuilding.

As someone who has witnessed the evolution of the U.S. maritime industry firsthand, I believe we are at a critical juncture. The foundations for growth are in place—rising interest among students, increased collaboration across sectors, and renewed public support for American manufacturing. But realizing the full potential of U.S. shipbuilding will require clear policy alignment, targeted investment in workforce development, and sustained commitment from industry leaders. If we can navigate these challenges together, the next generation will not only preserve our maritime legacy but strengthen it for decades to come.

-Norman Laskay

If you’d like to keep this conversation going, please email me at nlaskay@DLSmarine.com